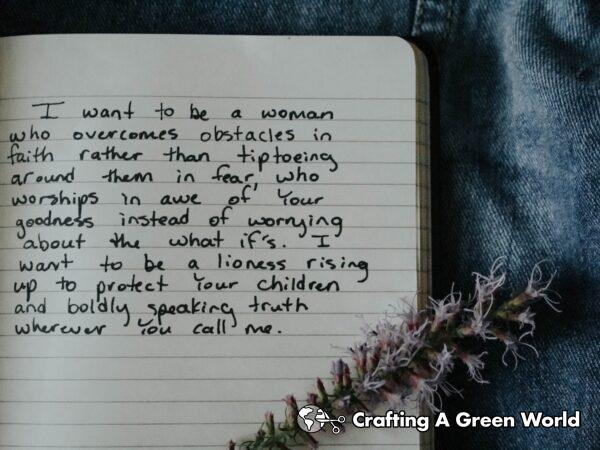

Starting a money journaling habit can be an enlightening endeavor. It’s a reflective time to sort out your financial thoughts, align your fiscal objectives, and foster a mindful approach towards financial wellness.

In this article, we’ll be sharing a plethora of money journal prompts to jumpstart your writing journey. Whether you’re looking to understand your spending habits, set financial goals, or simply enjoy the cathartic process of putting pen to paper, our carefully compiled list of prompts will guide you.

So, get your journal, find a comfortable spot, and let’s embark on this journey of financial introspection and responsible money management together. 🤗

Financial Goals Journaling

Financial Goals Journaling enables us to envision, strategize, and track progress towards achieving our monetary objectives, laying the foundation for financial wellness. Here are 20 prompts to kick-start your financial goals journaling journey:

- Define your short-term financial goals and describe the steps required for each.

- What is one long-term financial goal you have and why is it important?

- Reflect on a financial mistake you've made. What did you learn?

- How can you cut down your daily expenses to save money?

- Write a letter to your future self with the financial stability you aspire to have.

- How can you increase your income-earning potential?

- How do you envision your life if you achieve your current financial goals?

- Describe the steps you plan to take to reduce debt or stay debt-free.

- What does financial freedom mean to you?

- Describe how achieving your financial goals will impact your lifestyle.

- How can you make your money work for you (e.g., investments, businesses)?

- Write about a financial fear you have. How can you overcome it?

- How does your budget align with your financial goals?

- Reflect on your spending habits. How can they be improved?

- List three unnecessary expenses you can eliminate.

- Write about a time you made a smart financial decision. How can you replicate this success?

- What financial knowledge or skills do you need to learn or improve?

- How can your financial goals better align with your personal values?

- If you hit a financial jackpot tomorrow, how would you manage it?

- What steps can you take today to take you closer to your financial goals?

Money Mindset Exploration

Exploring your money mindset through journaling allows deep introspection of your attitudes and beliefs towards finance, and aids in forming positive financial behaviors. Here are 20 prompts that can guide you in your exploration of money mindset:

- Recall your earliest money memory. How has it shaped your current perspective?

- Reflect on a time you made a financial decision based on fear.

- What are your three main financial goals and why are they important to you?

- Write about a circumstance when money made you feel secure.

- Describe a situation where money brought stress into your life.

- List three ways you can improve your current financial situation.

- Think about the most significant financial mistake you've made. What lesson did you learn from it?

- What are the three traits you admire in financially successful people?

- Write a letter to your future self describing your ideal financial situation.

- Consider your attitudes towards debt. How do these beliefs affect your financial decisions?

- Reflect on your spending habits, especially impulsive purchases. What triggers these decisions?

- In what ways does the thought of retirement savings make you feel and why?

- Write about a moment when you felt proud of a financial decision.

- List three habits you can develop to become more financially responsible.

- What does financial freedom mean to you?

- How do your current spending habits align with your values and long-term goals?

- Write about a time where you had to sacrifice something for a financial reason.

- What steps would you take if you received a large amount of money unexpectedly?

- Consider your financial upbringing. In what ways has it influenced your approach to money management?

- What are the three most important financial lessons you would like to pass on to the next generation?

Debt-reflection Prompts

Debt-Reflection Prompts support understanding and managing your finances better by providing a guided introspection on your debt-related actions and choices. Here are 20 writing prompts to aid this self-exploration.

- Reflect on the moment you realized you were in significant debt. What were your initial thoughts and feelings?

- Write about the biggest challenge you face when paying off your debts.

- Describe the changes in your lifestyle you've had to make due to your current debt.

- What steps are you taking to ensure you don't accumulate more debt?

- Pen down your feelings when you make a major repayment towards your debt.

- Write about an instance where you had the opportunity to go into debt but chose not to.

- List three habits that you believe led to your current financial standing.

- Describe a time when you successfully paid off a debt. How did it make you feel?

- Are there any debts that cause you particular stress? Explain why.

- Explore how your life would look like if you were debt-free today.

- How has having debt affected relationships in your life?

- If you could change one financial decision that resulted in debt, what would that be and why?

- Write a letter to your future self about the lessons you have learned from being in debt.

- Record any recurrent thoughts you have about your debt.

- Expound on any fears you may have about paying off your debt.

- What sacrifices have been forced upon you in your journey towards being debt-free?

- Reflect on any debt you have recently cleared. List down your learnings from it.

- Describe your progress towards being debt-free from a year ago.

- Write about your key takeaways from your financial struggles.

- Finally, envision and describe your life post being debt-free. What steps are you willing to take to make it a reality?

Budgeting Thoughts

Budgeting thoughts through journaling can help you better appreciate your income, expenses, and financial goals, creating more awareness and control over your money. Below are 20 writing prompts about Budgeting Thoughts:

- How would you describe your current financial situation in three words?

- Write about your biggest financial worry. Why does it trouble you?

- Describe your perfect financial picture five years from now.

- List three things you can cut back on to save money.

- Write about a time when you had to stretch your budget. How did it feel?

- Reflect on your last major purchase. Was it worth the investment?

- Think about a financial goal you achieved recently. How did you make it happen?

- Jot down five ways you can increase your income.

- Write a letter to your future self about your current financial hopes.

- Reflect on a time when you experienced financial hardship. What lessons did you learn?

- List three financial habits you want to change. Why are they important?

- Define what financial freedom means to you.

- Recall a memorable experience that didn't cost you anything.

- Write about your financial role models and what you have learned from them.

- If money was not an issue, what would you do differently today?

- Reflect on how your upbringing influences your attitude towards money.

- If you had an extra $1000, how would you budget it?

- Describe a time when you felt satisfied with your financial situation.

- Identify three things you are saving up for and why they matter.

- Write down your top three strategies for sticking to your budget.

Saving Inspiration

Saving Inspiration through journaling allows us to generate effective money-saving strategies and encourages financial discipline. Here are 20 writing prompts aimed at sparking your Saving Inspiration:

- Recollect a situation where you saved money effectively. What strategies did you use?

- Write about a financial goal you wish to achieve. How much do you need to save for it?

- Imagine a situation where your savings bailed you out. What happened and how did it make you feel?

- List three money-saving methods you can implement this week.

- Think about an unnecessary expense you can reduce or eliminate. Write a plan for how you'll achieve this.

- Reflect on your most satisfying saving accomplishment. What made it so rewarding?

- Recall a moment where you resisted an impulsive purchase. What helped you stay disciplined?

- Write about a cost-efficient alternative you found for a typically expensive item or activity.

- Detail a financial mistake you made, and how you can avoid it in the future.

- Imagine an ideal financial situation. What saving habits contributed to this?

- Identify an area of spending where you can work on saving more money.

- Write about a person who inspires your saving habits. What can you learn from them?

- Detail five things you can do to cut costs in your daily life.

- Write about a financial risk that you avoided. What potential savings did that decision protect?

- Reflect on your long-term financial goals. How does saving help you achieve these?

- Identify a saving habit you want to develop. What are the benefits of this habit?

- Remember a time when you effectively used a budget. What made it successful?

- Write about how saving money makes you feel. Does it give you a sense of security or achievement?

- Come up with a fun and creative saving challenge for the next month.

- Reflect on your most important reason for saving money. How does it drive your behavior?

Spending Habits Reflection

Spending Habits Reflection through journaling prompts can spark valuable insights about our relationship with money, guiding us to make more mindful financial decisions. Here are 20 prompts to help you dive deep into the inner workings of your spending habits:

- Consider the last non-essential item you purchased. What was your motivation behind buying it?

- Reflect on a time when you consciously decided not to buy something. What influenced your decision?

- Write about a purchase that brought you lasting joy. Why do you think it had this effect?

- Describe an instance where you regretted making a purchase. What lessons did you learn?

- Identify three unnecessary expenses you could cut from your budget today.

- Think about a time where impulse buying got the best of you. What triggered this behavior?

- Write about the emotions that arise when you think about spending money.

- Evaluate the role of social influence in your spending habits. How can you manage this?

- Consider how your childhood experiences around money affect your current spending habits.

- Reflect on your last big-ticket purchase. Do you feel it was worth the price?

- Write about a time when you made a purchase under pressure.

- Describe a scenario where you deferred a purchase, and it turned out to be the right decision.

- List ways you could improve your purchasing decisions.

- Think about a time you prioritized saving over spending. How did it make you feel?

- Reflect on how your values align (or mismatch) with your spending habits.

- Write about your beliefs around money and spending.

- Consider the role of stress in your spending habits.

- Think about how your spending habits have changed over time.

- Reflect on the impact of your spending habits on your longer-term financial goals.

- Write about how curbing unnecessary spending could improve your overall wellbeing.

Investment Journaling

Investment journaling can open doors to personal financial growth by documenting, analyzing and reflecting upon your decision-making process and investment outcomes. Here are 20 prompts to help kick-start your investment journaling habit:

- Write about the reasons behind your most recent investment. What led you to make this decision?

- List five lessons you've learned from your worst investment so far.

- Describe an investment that performed better than you expected. What surprised you?

- Record the steps you took to research a recent investment. Was it worth the time and effort?

- Document your investment goals for the coming year.

- Think of an investor you admire. What qualities of theirs would you like to emulate?

- Reflect on a time you allowed fear or greed to influence an investment decision. What happened?

- Write about your long-term investment strategy.

- If you could go back in time, what investment decision would you change and why?

- How have your investment strategies evolved over time?

- Diagram the risk and reward balance of your current investment portfolio. Are you happy with it?

- Write a short piece on how the latest news might impact your investments.

- Track your emotional state during a period of market volatility. How did your emotions affect your decisions?

- Imagine teaching someone about investing. What are the three most important points you would discuss?

- Analyze a successful investment decision. What made it a success?

- Document an investment you decided against. Explain your reasons.

- List the strengths and weaknesses of your current investment portfolio.

- Reflect on a time when external advice influenced your investment decision. Was the outcome positive or negative?

- Describe a situation where you took a large investment risk. Was it worth it?

- Think about diversification in your portfolio. How can you improve it?

Income Planning

Income planning through journaling is a powerful way to gain perspective on your earnings and create a roadmap for financial stability and growth. Below are 20 prompts to help guide your reflections on income planning:

- Document your current income streams and provide an assessment for each.

- Explore what new income streams you would like to create in the future.

- List the steps you need to take to create new income streams.

- Reflect on a time when your income exceeded your expectations. How did it make you feel and how can you repeat this success?

- Write about how the stability of your income impacts your overall life and well-being.

- Evaluate your reliance on your primary source of income. How can you diversify your income streams?

- Write about the highest-paying job you’ve ever had. Will you strive to find similar positions?

- List five things you could do this week to increase your income.

- Describe your ideal income status in five years.

- Study your spending habits. How does this impact your current income planning?

- Write about your financial goals and how they map to your income.

- Explore any fears about income planning that you may have. Why do they exist and how can you address them?

- Identify 3 habits that may be negatively impacting your income.

- Reflect on a time when you had low or no income. How did it influence your current income planning strategies?

- Document your biggest income win so far this year.

- Imagine you got a raise today. What would you do with the extra income?

- Analyze the role of passive income in your overall financial plan.

- Write about what financial independence means to you and how income planning plays a role.

- Reflect on how your upbringing has shaped your attitude towards income planning.

- Think about what financial stability looks like for you. What income level would you need to feel stable and secure?

Retirement Future

Regulating your finances concerning your Retirement Future through journaling not only provides clarity and focus, but also encourages effective planning and preparation. Here are some writing prompts to guide you in meditating on your Retirement Future:

- Write down your vision of a perfect retirement. What does it involve?

- How much money do you think you'll need when you retire?

- What financial habits are you practicing currently towards achieving your retirement goals?

- Pen down three steps you're going to take this year to help you prepare for your retirement.

- How is your current lifestyle influencing your retirement savings?

- Consider a recent financial decision you made that impacts your retirement. What would you do differently?

- Enumerate potential sources of retirement income and how you can augment them.

- What are the challenges you foresee in maintaining your desired lifestyle post retirement?

- How are you planning to factor in medical expenses into your retirement funds?

- Describe the learning resources or tools you're using towards understanding retirement planning better.

- Write about how you will deal with the financial risks that might occur during your retirement.

- How are your retirement savings isolated from your daily life expenses?

- If planning your retirement was a journey, what milestones have you achieved so far?

- What plans do you have to reduce or eliminate your debt before retirement?

- Pen down how you foresee inflation affecting your retirement funds.

- How confident are you with your current retirement planning strategies?

- Reflect on the financial changes you are willing to make to ensure a comfortable retirement.

- Elucidate on the role of your family in your retirement planning.

- Draft a letter to your future retired self about your financial hopes.

- Identify three things you would want to leave behind as inheritance and how you plan to achieve that.

Financial Anxiety Conquering

Conquering financial anxiety involves understanding and managing your emotional response to money; journaling is a perfect tool for this. Below are 20 prompts that may guide you in tackling your financial worries:

- Write about a financial decision that you are proud of making. What led to this decision?

- Think about a time when you felt overwhelmed financially. How did you cope?

- List three habits that you believe contribute to your financial stress. How can you change them?

- Reflect on your biggest fear about money. Why do you think you have this fear?

- Envision your life without financial worries. What does it look like?

- Describe a situation where you overspent. How did it make you feel and what have you learned?

- Write a letter to your future self outlining your current financial goals.

- What is a financial habit you admire in someone else? Why and how can you adopt this habit?

- Reflect on a past financial mistake. What did you learn from it?

- Plan a budget for the next month. What are you allocating for necessary expenses, savings, and leisure?

- List 5 things that you can do today to ease your financial anxiety.

- What would financial freedom look like for you? How would you feel?

- Write about how your life would change if you reached your financial goals.

- Think about a thing or situation that makes you feel financially insecure. What steps can you take to feel more confident?

- Reflect on the relationships in your life and how they are affected by your financial situation.

- List three financial successes you had in the last month. Big or small, how did they make you feel?

- Think about unexpected expenses. How can you better prepare for them in the future?

- Envision yourself five years from now, financially. What do you want to achieve?

- Detail a plan on how you intend to conquer your financial anxiety.

- Close your eyes and think about your stressors, financial and otherwise. Write a letter of encouragement to yourself.

Charitable Giving

Exploring Charitable Giving through journaling can foster a greater understanding of our financial choices and their potential for helping others. Here are 20 journaling prompts to help you dive deeper into your thoughts and feelings about charitable giving:

- Recall the first time you gave to a charitable cause. What inspired you to donate?

- Write about a time when you felt compelled to give, but couldn't. Why was that?

- Reflect on the most rewarding donation you've ever made. What made it so special?

- Think about a cause that's close to your heart. How could you contribute financially?

- Imagine you've won a substantial amount of money. How much would you donate and to whom?

- Explore any resistance you feel around giving charity. What might be the source of this?

- Describe a person or organization that you admire for its charitable work.

- How would your life be different if you committed to a regular donation schedule?

- Write a letter to a future you who is more giving. What advice or encouragement would you give?

- Consider your budget. What are some ways you could adjust it to allow for more charitable giving?

- Journal about a time when you regretted a charitable contribution. Why was that?

- If you could start a charitable organization, what cause would it serve?

- Do you prefer to give money, time, or talents to charity? Why is that?

- Reflect on a time when you were on the receiving end of charity. How did that experience influence your view on giving?

- How does your family's attitude towards charitable giving affect your own?

- Imagine you could convince a friend to donate to a charity. How would you persuade them?

- Write about a charitable cause you feel does not get enough attention or funding.

- Consider the influence of your work on your charitable giving. Does it motivate or limit you?

- How does it make you feel when you see others giving generously to causes you care about?

- Reflect on your overall feelings about charitable giving. Are you mostly positive, negative or neutral? Why is this so?

Financial Independence Journey

Exploring your journey to financial independence through journaling can help you understand your spending habits, savings aspirations, and overall financial goals more deeply. Here are 20 money journal prompts about your financial independence journey:

- Write about what financial independence means to you personally.

- Reflect on a time when your financial decision led to a positive outcome.

- Outline your long-term financial goals and explain why you have chosen them.

- Describe a financial mistake you have made, and what you learned from it.

- Detail three changes that you can make today for a better financial future.

- Write a letter to your future self, discussing your financial aspirations.

- Analyze your current spending habits and how they align with your financial goals.

- Narrate a moment when you felt financially independent and confident.

- Expound on a financial habit you wish to change and plan how to do it.

- Write about a personal finance book, course, or seminar that influenced your financial thinking.

- Describe your ideal lifestyle when you achieve financial independence.

- List down five steps to lower your expenses and increase your savings.

- Write about a time when you had to prioritize your spending. How did you decide what was more important?

- Reflect on how your upbringing influenced your perspectives on money and wealth.

- Narrate a scenario where you saw the impact of financial planning in real life.

- Define what a financially secure future looks like for you.

- Come up with a milestone reward system for each of your financial goals achieved.

- Describe how you felt when you made your biggest financial investment.

- Outline how you plan to increase your income to expedite your financial independence.

- Write about how financial independence can improve your overall quality of life.

Wealth Distribution

Diving deep into the topic of Wealth Distribution through journaling can lead us to gain a clearer understanding of our financial attitudes, perceptions, and strategic planning for future wealth. Here are 20 journal prompts to inspire your reflections on Wealth Distribution:

- Reflect on your current understanding of wealth distribution. How does it influence your financial decisions?

- Write about the most significant income shift you've experienced. How did that change your lifestyle or financial habits?

- Describe your ideal wealth distribution. How is it different from your current financial situation?

- List three actions you could take in the next month to work toward a more balanced wealth distribution.

- Imagine you've received an unexpected windfall. How would you distribute this wealth?

- Consider times when you've felt financially secure. Did wealth distribution play a role in your sense of security?

- Reflect on the way wealth was distributed in your family growing up. How has that influenced your financial habits?

- How would you distribute your wealth if you had no financial constraints whatsoever?

- Write a letter to your future self, expressing your hopes and plans for wealth distribution.

- Jot down your feelings about wealth disparity on a global scale. How does it impact your personal views on wealth?

- Write about a moment when you felt the impact of uneven wealth distribution.

- List three changes that could improve wealth distribution in your community.

- How does your wealth distribution align with your personal values?

- Explain the role of charity or philanthropy in your approach to wealth distribution.

- How would you educate a child about the concept of wealth distribution?

- Consider any fears or anxieties surrounding wealth distribution – how could you address them?

- Explore your beliefs on the balance between wealth accumulation and distribution.

- Are there any areas in your life you think are excessively or insufficiently funded? How would you adjust this?

- Journal about how your perception or understanding of wealth distribution has changed over the years.

- What are your hopes for wealth distribution in the future? How can you turn these hopes into an action plan?

Entrepreneurial Venture Reflections

Entrepreneurial Venture Reflections enables us to understand and process the financial aspects of our business ventures, providing insights for growth and improvement. Here are 20 prompts you can use to facilitate this reflection process in your money journal:

- Write about your most successful entrepreneurial venture. What was the key to its success?

- Reflect on a venture that didn't go as planned. What lessons did you learn from the experience?

- Think about a risk you took in your business. What was the outcome?

- Imagine your business five years from now. What financial accomplishments do you see?

- Journal about the most difficult financial decision you had to make for your business and its impact.

- Describe an idea you have for a new venture. What are the potential financial outcomes?

- List three financial goals for your business for the coming year.

- Write about a time when you had to pivot your business strategy for financial reasons.

- Reflect on a financial mistake you made in your entrepreneurial journey. How did you rectify it?

- Think about your pricing strategy. Is there anything you would like to change?

- Describe a situation where you had to negotiate a business deal. What was the result?

- Consider three different ways you could increase your income through your business.

- Reflect on your biggest financial worry related to your business right now.

- Journal about your financial expectations when you started the venture versus the reality now.

- Write about a financial victory that made you proud.

- Think about an entrepreneur you admire. What financial decisions they made that you can learn from?

- Describe the worst financial advise you've received regarding your entrepreneurship journey.

- Reflect on the biggest financial challenge in maintaining a sustainable business.

- Consider a time when you had to make a difficult budgeting decision in your business.

- Write about any financial aspect of your business that you would like to improve or change.

Cost Of Living Assessment

Assessing your cost of living through journaling can provide valuable insights into your spending habits and living standards, allowing for thoughtful consideration and potential adjustments to your lifestyle. Here are 20 prompts to help you to reflect on your cost of living:

- Break down your monthly expenses. What are your biggest costs?

- Reflect on your last significant purchase. Was it a want or a need?

- Write about a time you had to adjust your lifestyle due to financial constraints.

- Describe a recent situation when you made a decision based on cost, rather than desire or need.

- Reflect on one way you could decrease your monthly utility bills.

- Imagine lifestyle changes you could make if you moved to a place with lower cost of living.

- Identify three non-essential items you regularly spend money on.

- Write about how you can reduce your grocery bills without compromising nutrition.

- Reflect on how the cost of living affects your ability to save money.

- Assess the financial impact of daily habits, like buying coffee or lunches out.

- Write about a lifestyle change you could make to reduce transportation costs.

- Reflect on what quality of life means to you and how it relates to your living costs.

- Write about how your current housing costs align with your income.

- Identify one area where you could cut costs to invest in something meaningful to you.

- Reflect on how changes in your income would impact your living standards.

- Write about an area in your spending habits where you'd like to improve.

- Identify one cost you don’t mind splurging on and why it’s worth it.

- Reflect on how you budget for unexpected experiences and emergencies.

- Write about how financial stress impacts your overall well-being.

- Reflect on the balance between your income, cost of living and desired lifestyle.

Manifesting Abundance

Manifesting abundance through journaling encourages an optimistic perspective towards wealth and prosperity, instilling the belief that financial success is reachable. Here are 20 prompts to assist you in manifesting financial abundance in your daily journal routine:

- Visualize your perfect day if money was not a factor. Describe it in as much detail as possible.

- Recall a past financial win – a high-paying job, a profitable investment. What did that moment feel like?

- List five things you'll do once you've manifested the financial abundance you desire.

- Write down five ways you can give back to the community once you achieve financial success.

- Envision having unlimited resources. What would you change about your lifestyle?

- List three traits you admire about individuals who've achieved financial success. How can you embody these traits?

- Reflect on a time when you faced financial struggle. How did you overcome it, and what did you learn?

- Imagine being financially secure – how does that security make you feel?

- Write a letter to money, express your feelings towards it and your plans for it in your life.

- Note down five habits you aim to develop to attract financial success.

- Write an affirmation for wealth that you can look at daily.

- Describe a financial mistake you made – what did it teach you?

- Create a vivid description of your dream home, car, or vacation, keeping no financial limitations in mind.

- Describe an experience where you felt truly abundant – it doesn't have to be finance-related.

- Craft your 'money mantra' that you can repeat daily for attracting wealth.

- List five ways you can create multiple income streams.

- Write about how you will feel when you achieve your financial goal.

- Reflect on a financial decision that positively impacted your life and why.

- Write a thank you letter for all the abundance already present in your life.

- Document a step-by-step action plan for achieving a specific financial goal.

Money Management Skills

Fostering money management skills through journaling can empower people to gain control over their financial situations and create the monetary future they desire. Here are 20 prompts focused on enhancing your money management skills:

- Reflect on your current financial status. How do you feel about it?

- Describe your ultimate financial goal. How will your life change when you achieve it?

- Write a list of all your income sources. Are there any opportunities to increase your income?

- Identify your essential and non-essential expenses. In what areas can you reduce expenditure?

- Think about a big purchase you made in the past. Do you regret it or do you believe it was a good investment?

- Write about your dream holiday. How much would it cost and how can you afford it?

- Examine your relationship with money. Has it changed over the years?

- Note down your biggest financial fear. What steps can you take to conquer this fear?

- Write down your most successful financial decision. What encouraged you to make this decision?

- Think about a time you gave money to a cause you believe in. How did that make you feel?

- Visualize and describe your life five years from now. How does your financial scenario look?

- Considering your current spending habits, where do you foresee your finances in one year?

- List three financial habits you wish to develop this year.

- Write about a financial advice that had a significant impact on you. Why did it resonate with you?

- Discuss a financial mistake you made. What did you learn from it?

- Envision paying off a significant debt. How does that make you feel?

- Consider your lifestyle. Are there any changes you can make to better manage your money?

- Jot down your financial priorities for the next month. How will you achieve them?

- Reflect on your saving habits. How can you improve them?

- Write about your ideal retirement. How are you financially preparing for it?

Emergency Fund Planning

Emergency Fund Planning via money journal prompts allow us to become more intentional about saving for unforeseen costs and achieving financial stability. Here are 20 prompts to guide you in building, maintaining, and utilizing your emergency fund:

- Enumerate the reasons why you believe having an emergency fund is necessary.

- Write down three situations where an emergency fund could help you.

- In the event of a financial crisis, how much do you think you will need in your emergency fund?

- List down five sacrifices or adjustments you can make to contribute to your emergency fund.

- Reflect on what your current saving habits are and how you can improve them for your emergency fund.

- Write about any fears or concerns you may have about starting an emergency fund.

- Set a realistic goal for your emergency fund for the next six months.

- Describe how you feel about using your emergency fund when necessary.

- Track your progress over the past month towards your emergency fund goal.

- Write about any setbacks in your emergency fund planning and how you can overcome them.

- Envision how your life would be different with a fully funded emergency savings.

- List three habits that hinder your capacity to save and how you can change them.

- Reflect on any past experiences where an emergency fund would have helped.

- How do you intend to keep yourself motivated in reaching your emergency fund goal?

- Write a letter to your future self describing the peace of mind having an emergency fund brings.

- Describe the steps you took this week to move closer to your emergency fund goal.

- Reflect on how your feelings towards emergency fund planning have evolved over time.

- Note any helpful resources or tools you've found useful in your emergency fund planning.

- List down any personal rules you have about when to use the emergency fund.

- Write about how you plan to replenish the fund if you ever needed to use it.

Financial Success Visualization

Through visualization of financial success within journaling, we are able to manifest our goals and ambitions more concretely, providing a clear path towards achieving them. Here are 20 prompts to guide you in this technique within your money journaling journey:

- List three financial goals that you'd like to achieve within the next few years.

- Describe how achieving these goals would improve your life.

- Visualize how you'll celebrate once you reach your primary financial goal.

- Describe how you feel now and compare it to how you'll feel when you achieve financial stability.

- Visualize where you'll be living once you've obtained financial success. Describe it in detail.

- Write about who you could help or what philanthropic efforts you could support once you achieve your financial goals.

- Describe your ideal working condition after achieving your financial goals.

- Reflect on what habits or routines you might need to change to reach your financial goals.

- Imagine you're budgeting your future successful financial life. What does it look like?

- Picture your stress levels regarding finances five years from now after achieving success. Write about what has changed.

- Reflect on your financial education journey so far and how its leading towards success.

- Outline the steps you plan to take in the next six months to reach your financial goals.

- Describe how your regular day would look like after achieving financial success.

- Imagine a conversation with a close friend or family member after you have achieved your financial goals. What would you say?

- Visualize your dream vacation that you'd take after financial success.

- Write a letter to your future self, the one who has achieved all the financial goals.

- Reflect on how achieving your financial goals is going to influence your overall happiness and lifestyle.

- Picture yourself retiring comfortably because of your financial success.

- Visualize your life without any debt. How does this change your daily routine?

- Describe how you would feel knowing that you have a secure financial future for yourself and your family.

Impulse Spending Control

Managing impulse spending through journaling empowers us to critically assess our spending habits, find areas to improve, and rectify them. Below are 20 writing prompts to aid you in mastering impulse spending control:

- Recall a recent purchase that was made impulsively, why do you think it happened?

- Write about the feelings you experience before making an impulse purchase, and how you feel afterwards.

- Describe the ideal relationship you wish to have with money.

- List out three strategies you can use to control your impulse spending.

- Reflect on the consequences of your impulse purchases. How has it affected your overall financial situation?

- Think about a time when you resisted an impulse buy. How did you manage to do so?

- Write a letter to yourself explaining the importance of disciplined spending.

- Document your most frequently purchased impulse items.

- Think about the triggers that lead to impulse purchases. Are there patterns?

- List five ways you can use your money instead of making an impulse purchase.

- Write a scenario of a successful shopping trip without any impulse purchases.

- Reflect on your values and goals. How does impulse buying affect them?

- Review your last month’s expenses and identify any impulse purchases.

- Imagine your life in a year if you continue making impulse purchases. What do you see?

- Dedicate one entry to describing the worst impulse buy you've ever made.

- Consider your budget. What could you afford if you reduced your impulse spending by half?

- Create a list of “questions to ask yourself” before every purchase to avoid impulse buying.

- Reflect on the connection between your emotions and your impulse purchases.

- Write about how your life would change if you had total control over your impulse spending.

- Set achievable financial goals for yourself for the next month, keeping in mind the need to control impulse spending.

Deconstructing Money Myths

Deconstructing Money Myths through journaling allows us to challenge and reevaluate our inherent beliefs about money that may inhibit us from achieving financial success. Here are 20 prompts to guide you in dispelling common misconceptions about money:

- Write about a money myth that you were taught growing up. How has it affected your financial decisions?

- Reflect on whether you believe that "Money can't buy happiness." Why or why not?

- Do you think "Money is the root of all evil?" Journal about instances that support or negate this perspective.

- Discuss your thoughts on "The rich get richer, and the poor get poorer." Is this always the case?

- List down five common misconceptions about investing and challenge them with knowledge you've gained.

- Write about your belief in the saying "You need money to make money." How does this impact your financial choices?

- Explore the myth "Once I have X amount of money, I'll be happy."

- Reflect on the idea "Time is money." Is time always equivalent to money for you?

- Discuss the belief "There is not enough money to go around." How has it influenced your perception of wealth?

- Write about "More money, More problems." Are these problems inevitable with wealth accumulation?

- Evaluate your agreement with "Money changes people." Does it always happen?

- Journal about how the belief "Money can't purchase love" affects your relationships.

- Reflect on how much truth you think there is in "Poverty is a virtue."

- Write about the story that "Middle-class people can't become millionaires." Is it accurate?

- Elaborate on the belief "Wealthy people are greedy." Give examples to support or refute this.

- Reflect on "It takes a lot of risk to earn a lot of money." Is it always true?

- Does "Hard work equals more money" resonate with you? Why or why not?

- Write about "Money brings security." Is it the only foundation for safety?

- Journal about the phrase "Money talks." How does it influence your connections or dealings with others?

- Explore the belief "Money can ruin relationships." Is money the real culprit or the handling of it?

Financial Mistakes Analysis

Analyzing financial mistakes in your money journal can provide essential insights into your spending habits and aid you in making informed decisions regarding money management. Here are 20 prompts to aid you in analyzing financial mistakes:

- Reflect on a financial decision you regret making. Why do you think it was a mistake?

- Write about an investment that didn't pan out as expected. What lessons did you learn?

- Describe a situation when you overspent. What were the consequences?

- Identify three ways you could have avoided a financial mistake you made in the past.

- Consider a time when you failed to save for an important goal. What could you have done differently?

- Write about a moment you purchased something on impulse. What triggered this decision?

- Examine a time when you did not track your expenses. What were the ramifications?

- Reflect on a financial risk you took that didn't pay off. What can you learn from this?

- Think about a budget you failed to follow. What led to this failure?

- Describe a time when you ignored financial advice. How did it impact you financially?

- Analyze a habit that leads to frequent financial blunders. What solutions can you think of?

- Discuss a time when you didn't plan for financial emergencies. What were the outcomes?

- Record a financial mistake that led to significant debt. How can you prevent this in the future?

- Think about a time when you chose a quick money-making scheme. Was it beneficial in the end?

- Reflect on a moment when you took on unnecessary financial responsibilities.

- Write about a time when you didn't diversify your investment portfolio. What was the effect?

- Discuss a point in your life when you lived beyond your means. What steps can you make to avoid this?

- Recall a financial mistake you repeated. Why did this recur and how can you rectify it?

- Reflect on a time when you didn't prioritize paying off high-interest debt. What can you do differently?

- Write about a time when you ignored long-term financial planning. How can you improve on this?

Financial Gratitude Exercise

Financial Gratitude Exercise is a nurturing act of acknowledging and appreciating the financial aspects of your life through journaling. Below are 20 prompts to guide you in practicing financial thankfulness in your money journaling routine:

- Write about a recent financial victory, no matter how small.

- List three things you were able to purchase this month that you are grateful for.

- Reflect on a time when you were financially challenged and overcame it.

- How does financial stability make you feel and why?

- Reflect on the work you do and how it contributes to your financial well-being.

- Describe a purchase that significantly improved your quality of life.

- Write a thank-you letter to yourself for making smart financial decisions.

- Recall a moment when you felt truly satisfied with what you have.

- Write about a time when you generously helped someone with your own money.

- Look around you and list five objects that exist in your life because of your financial capacity.

- Think about your financial journey. What are you most proud of?

- Describe a financial decision that led to unexpected joy or benefit.

- Write about a money-related fear you overcame.

- List three financial habits you are grateful for developing.

- Reflect on the biggest financial lesson you’ve learnt and how it has improved your life.

- Describe a financial goal you achieved and how it made you feel.

- Write about an instance where you were grateful for a financial safety net or backup plan.

- List things you could afford this week that contributed to your happiness or well-being.

- Think about a gift you bought for someone which brought you joy.

- Lastly, write a note of financial gratitude to yourself for where you stand today and what you aim for tomorrow.

Frugal Living Thoughts

Frugal Living Thoughts through journaling allows us to explore ways we can better save and manage our finances, enhancing our understanding of our spending patterns and potential savings. Below are 20 journal prompts focused on Frugal Living Thoughts:

- Identify a recent purchase that you could have avoided. How could you prevent such spending next time?

- Write about an instance when you felt proud of your frugal decision. What made it successful?

- Consider a habit that leads you to overspend. How can you modify it to save money?

- List three cost-saving alternatives to your biggest regular expense.

- Visualize your financial state one year from now if you live more frugally. What changes do you see?

- Detail a self-care activity that is inexpensive yet effective.

- Write about someone who lives frugally and inspires you. What can you learn from them?

- Think of a service or subscription you can do without. Why is it unnecessary?

- Describe ways you can make your favorite meal cheaper.

- Imagine a no-spend day. What activities would you do?

- Identify a thrifty swap for a luxury you enjoy.

- Consider an area in your life where sporadic spending occurs. How can you change it to a planned expense?

- Write about a resource you can use to learn more about frugal living.

- Picture your life with fewer material possessions. How does it look and feel?

- Identify a regular purchase. How can you DIY it to save money?

- Think about an upcoming event or holiday. How can you celebrate it frugally?

- Describe a technique you can use to curb impulse buying.

- Write about a purchase you regretted. What frugal alternative could have been used instead?

- Identify three small, daily changes you can implement for a more frugal lifestyle.

- Write a letter to your future self highlighting your commitment to frugal living and the benefits you hope to reap.

Money And Happiness Correlation

Understanding the correlation between money and happiness can inform us about how wealth impacts our mental and emotional well-being. Here are 20 journal prompts to instigate thought and discussion on this correlation:

- How does your current financial situation contribute to your overall happiness?

- Write about a time when you felt financially secure. How did that impact your happiness?

- Has there ever been a moment where an increase in money led to a decrease in happiness? Describe it.

- In what ways does money bring happiness into your life?

- Think about a time when you had less money. Did this deficit affect your joy and contentment?

- Write a letter to your future self, narrating your current thoughts about the relationship between money and happiness.

- Describe a situation where you chose happiness over money. Have you ever regretted this decision?

- Can you envision a form of happiness that cannot be purchased with money?

- Has money ever created stress or unhappiness in your life? How did you cope with it?

- Debate whether money can buy happiness in your opinion. Support your stance with personal experiences.

- Write about someone you know who seems happy without a lot of money. What could you learn from them?

- How would you invest money to increase your happiness?

- Has your perception of the correlation between money and happiness evolved over time? If so, how?

- What changes can you make now to improve your financial situation and happiness simultaneously?

- Recall a moment when you felt happiest. Was this moment financed or free?

- Are there any negative experiences or fears you associate with having more money?

- If you had unlimited wealth, what activities or things would you buy to increase your happiness?

- Has there been a situation where you had to sacrifice your happiness for money? Describe it.

- In what ways might your life change unexpectedly if you suddenly inherited a large sum of money?

- Reflecting on your past, how has money influenced your life decisions and overall happiness?

Couples Finance Communication Prompts

Couples finance communication prompts serve as a catalyst in sparking constructive conversations and facilitating openness about money matters in relationships. Here are 20 prompts to guide you through this aspect of your money journaling journey:

- Discuss your first memory of using money. How has it shaped your spending habits?

- Write about a financial goal you both want to achieve together.

- Reflect on a financial disagreement you had and how you resolved it.

- Write down your individual attitudes towards saving. Where do you see similarities and differences?

- Discuss how your upbringing has influenced your present attitude towards money.

- List five mutual financial fears and discuss strategies to tackle them.

- Write about each other's spending habits and discuss how they affect your joint finances.

- Describe how you feel when you need to discuss important financial matters with your partner.

- Visualize where you both want to be financially in 5 years and jot down the steps to get there.

- List three aspects you admire about your partner’s approach to money.

- Write about a financial blunder you made and what you learned from it.

- Discuss your perspectives on financial independence within the relationship.

- Share one financial secret you’ve never discussed before.

- Discuss your budgeting methodologies and how you can incorporate the best of both.

- Reflect on a time when money created stress in your relationship and how you managed it.

- Write about how you feel after making a major joint purchase.

- Share a financial success story from your relationship.

- Discuss the role of financial education in your relationship’s growth.

- Write about a regular expense that you can eliminate or reduce to save more.

- Share your views on investing for the future and retirement planning.